Kenosha County has received a AAA bond rating from S&P Global Ratings for the fifth consecutive year.

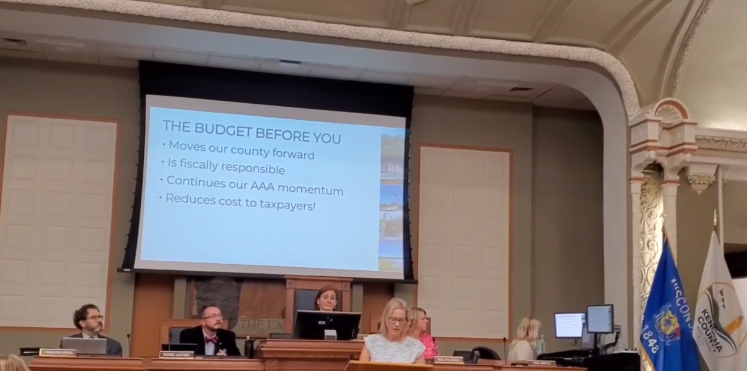

The rating, the highest possible, reflects the county’s strong fiscal health and outlook, and it results in a savings for taxpayers, County Executive Samantha Kerkman said.

“Kenosha County is proud to be one of just seven Wisconsin counties with AAA status — a distinction we’ve now held for five years running,” Kerkman said. “This is a testament to our continued fiscal health and the result of the hard work and diligence of our Finance team and the County Board.”

County Board Chairman Monica M. Yuhas said the continued AAA recognition from S&P confirms the county’s fiscal policies are working and it is well-positioned for the future.

“Maintaining our AAA bond rating is no small task,” Yuhas said. “It is the direct result of thoughtful decision-making, a willingness to plan for the long term, and a shared belief that taxpayer dollars must be managed with the highest level of care.”

“This rating translates into real benefits for our residents — from saving millions in interest on major projects to ensuring we have the flexibility to invest in our community when it matters most,” Yuhas added. “This is about safeguarding our county’s future.”

The S&P report indicated the continued AAA rating is supported by Kenosha County’s “robust fiscal management that has contributed to a trend of mostly positive operations and healthy reserves.”

The report noted the strong economic growth trend in the county, expected to continue with the recently announced development plans from major corporations including Eli Lilly & Company and Microsoft.

Along with the rating, S&P issued a stable outlook, which the report states “reflects our expectation that Kenosha County’s well-managed budget, steady economic expansion, and extra levy capacity will ensure generally balanced budgetary performance and a healthy overall financial position in upcoming years.”

Kerkman noted that holding the top-level AAA rating benefits taxpayers as it results in lower interest rates when the county secures funding for major projects.